Best Copy Trading Platforms 2022 – Compare Social Trading Platforms

Copy trading platforms allow investors to mirror the positions of a seasoned pro.

This means that anything the trader invests in will be replicated in the user’s own portfolio – paving the way for a passive trading experience. In this guide, we compare the best copy trading platforms in the market today.

Best Copy Trading Platforms 2022

The best copy trading platforms to consider right now can be found in the list below:

- eToro – Overall Best Copy Trading Platform for 2022

- AvaTrade – Regulated CFD Trading Platform That Supports Copy Trading Accounts

- ZuluTrade – Top Copy Trading Platform for Customizable Tools

- DupliTrade – Follow and Copy Advanced Trading Strategies

- NAGA -User-Friendly Social Trading Platform With a Great Reputation

- MetaTrader 4 – Advanced Third-Party Platform With Copy Trading Tools

- cTrader – Great Copy Trading Platform for Free Strategies

Cryptoassets are a highly volatile unregulated investment product. Your capital is at risk.

Readers can find the outcome of our in-depth copy trading platform reviews further down.

Top Social & Copy Trading Platforms Reviewed

In choosing the best copy trading platform, investors will need to ensure that there is a large pool of traders to select from.

Investors will also need to explore what fees apply to copy another trader, whether there is a minimum investment requirement, and which asset classes are supported.

Below, we offer full and detailed reviews of the copy trading platforms for 2022.

1. eToro – Overall Best Copy Trading Platform for 2022

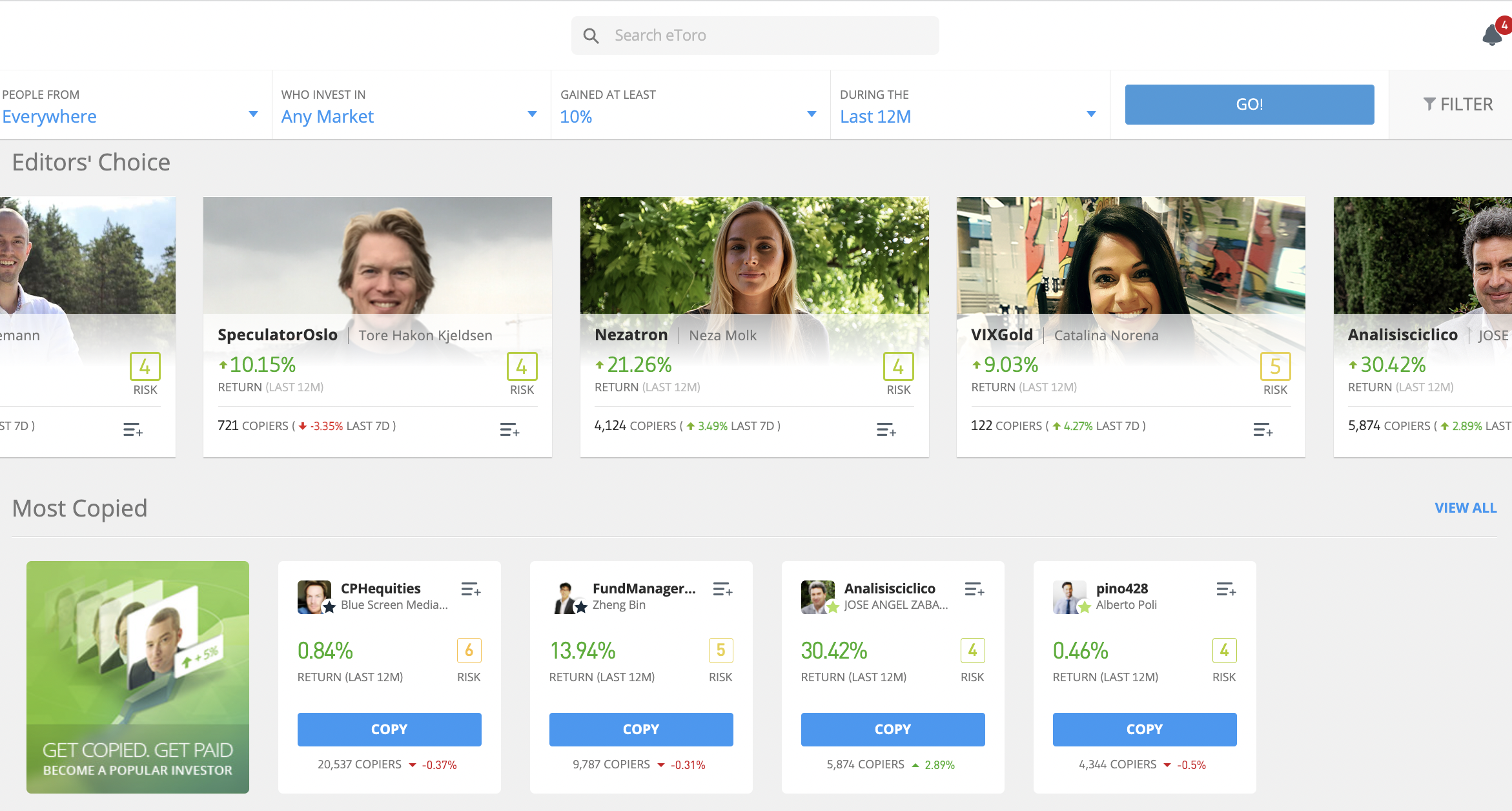

We found that when compared to other providers in this space, eToro is clearly the overall best copy trading platform in the market. eToro is home to thousands of verified traders that can be copied at the click of a button – so there is an investor to suit most financial goals. It’s also one of the best Islamic brokers that’s regulated by a wide range of financial authorities.

We found that when compared to other providers in this space, eToro is clearly the overall best copy trading platform in the market. eToro is home to thousands of verified traders that can be copied at the click of a button – so there is an investor to suit most financial goals. It’s also one of the best Islamic brokers that’s regulated by a wide range of financial authorities.

The minimum amount that needs to be allocated to each trader is just $200. There are no additional fees required to copy a trader, which means that there is no requirement to engage in a profit-share arrangement. What we really like is that eToro offers a wide range of filters, which makes finding a suitable trader a breeze.

For instance, users can search for a trader based on their historical trading results, preferred asset class, assigned risk rating, maximum drawdown, and more. Once a trader is selected and the position is confirmed, any future investments will be mirrored in the investor’s own eToro portfolio. Therefore, the eToro copy trading tool allows users to trade passively.

There is the option to add or remove assets to the portfolio, and the trader can stop being copied at any given time. Supported assets on the eToro platform include thousands of stocks and ETFs, not only from the US, but more than a dozen international markets. eToro also allows users to invest in cryptocurrency, forex, indices, and commodities.

We like that eToro does not charge any commission on stocks and ETFs, while other asset classes come with competitive fees. The minimum deposit to get started with eToro is just $10 for those in the US. Payments made in US dollars do not attract any deposit or withdrawal fees. Plus, the platform supports debit/credit cards, e-wallets, and bank transfers.

eToro also offers a virtual portfolio that comes pre-loaded with $100k in paper trading funds. This allows users to test the copy trading feature out before risking real money. We also like that eToro offers the best copy trading app for iOS and Android. This allows users to invest in new copy traders and check the value of open positions.

In addition to its core copy trading tool, the eToro social trading platform is also worth a look. For instance, eToro users can publish a post outlining their thoughts on a particular asset. Other users can comment on the post and even ‘like’ it. It is also possible to follow like-minded users. As well as a leading copy trading platform eToro is also considered by many day traders as the best scalping broker in 2022.

Perhaps the most important aspect of the eToro platform is that it is authorized and regulated by FINRA and the SEC. It is also regulated by the FCA, ASIC, and CySEC. Finally, getting started with an eToro account takes just five minutes from start to finish – which includes the automated KYC process.

| Supported Assets for Copy Trading | Stocks, ETFs, crypto, forex, indices, commodities |

| Social Trading Tools? | Yes – like, follow, and post |

| Fees | No additional fees for copy trading service |

| Minimum Copy Trading Investment | $200 per trader |

Pros

- The overall best copy trading platform

- Choose from thousands of verified copy traders

- Comment and ‘Like’ messages from other traders

- The minimum copy trading investment is $200

- No additional fees to use the copy trading tool

- Heavily regulated broker

- Supported assets include stocks, ETFs, forex, crypto, and commodities

Cons

- No support for third-party platforms like MT4

Cryptoassets are a highly volatile unregulated investment product. Your capital is at risk.

2. AvaTrade – Regulated CFD Trading Platform That Supports Copy Trading Accounts

The next provider to consider from our list of the best copy trading platforms is AvaTrade. This platform specializes in contracts-for-differences (CFDs) across more than 1,250 instruments. While AvaTrade does not directly support copy trading, it does offer integration with third-party providers.

This is inclusive of ZuluTrade and DupliTrade – which we discuss in more detail shortly. Nonetheless, both of these third-party platforms allow users to copy the trades of seasoned investors at the click of a button. In order to go through AvaTrade, an account must first be opened and a minimum deposit of $100 should be met.

Then, the user will need to select their preferred third-party provider and subsequent investor to copy. AvaTrade might suit those that wish to combine copy trading with a personalized strategy. This is because AvaTrade allows investors to buy and sell CFD instruments at 0% commission alongside competitive spreads.

Supported markets include stocks, forex, cryptocurrencies, and indices. It is also possible to access leverage on the AvaTrade platform, and limits will depend on the user’s country of residence and the respective asset being traded. Supported payment methods on this platform include debit/credit cards and bank wires.

Another benefit of using AvaTrade is that it supports MT4 and MT5. Both of these platforms offer access to diverse trading tools, customizable charts, advanced order types, and plenty of technical indicators. There is also the AvaTrade app for iOS and Android. This allows the user to keep tabs on any open copy trading positions, as well as place new orders.

| Supported Assets for Copy Trading | Depends on chosen third party |

| Social Trading Tools? | No |

| Fees | 0% commission, but third-party fees might apply |

| Minimum Copy Trading Investment | Depends on chosen third party |

Pros

- Connect account to ZuluTrade and DupliTrade

- Regulated by 8 licensing bodies

- Minimum deposit is just $100 – and no transaction fees

- Leverage and short-selling supported

- Accounts take just minutes to open

- Top-rated mobile app

Cons

- Does not directly support copy trading on its platform

- CFD instruments only

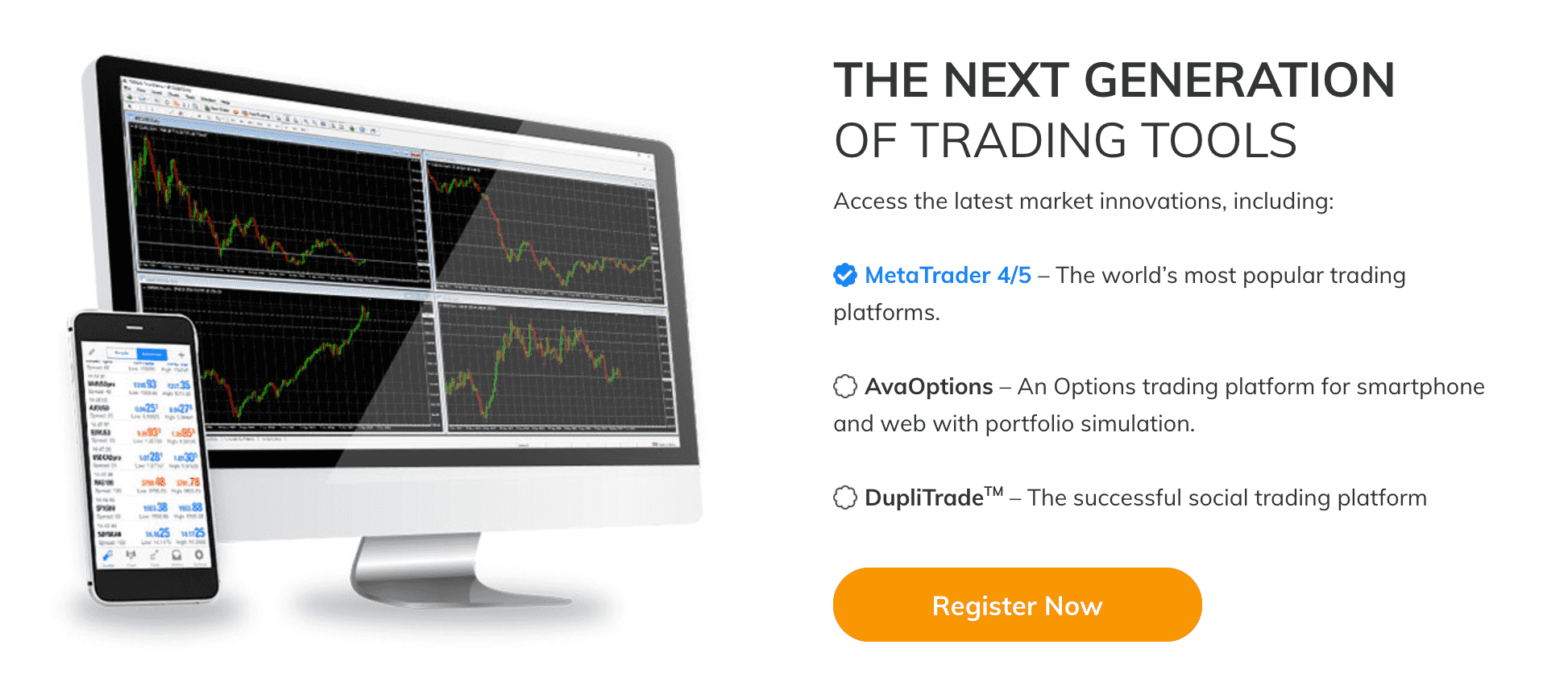

3. ZuluTrade – Top Copy Trading Tool for Customizable Tools

![]() ZuluTrade is a social trading broker that carries a great reputation in this space. It offers a user-friendly interface that should appeal to most investor profiles. When engaging in copy trading via ZuluTrade, users will have access to a plethora of data.

ZuluTrade is a social trading broker that carries a great reputation in this space. It offers a user-friendly interface that should appeal to most investor profiles. When engaging in copy trading via ZuluTrade, users will have access to a plethora of data.

This provides adequate information on how each trader has performed since joining ZuluTrade, and which assets they generally like to gain exposure to. We like that ZuluTrade allows its users to access a range of customizable tools. For instance, the Automated tool allows users to set up stop-loss and take-profit orders on the traders that they copy.

This ensures that the user’s personal goals and tolerance for risk are met. There is also a social trading network and a simulation tool that allows users to test the performance of a copy trader. Supported markets on this platform include cryptocurrencies, stocks, indices, commodities, and forex.

In terms of fees, this will depend on the account being opened – of which there are two options. First, the classic account allows the user to engage in copy trading on a commission-free basis. However, there will be wider spreads to cover. Second, the profit-sharing account costs $30 per month.

No increased spreads or commissions apply, but a share of profitable trades made by the copy trader will apply. We also like the social feed offered by ZuluTrade. This operates like a social media platform, insofar that ZuluTrade users can post, like, and comment in a public setting. It is possible to view and search for trending hashtags to see which assets and markets are hot.

| Supported Assets for Copy Trading | Forex, stocks, indices, crypto, commodities |

| Social Trading Tools? | Yes – social feed with posts, likes, and comments |

| Fees | Free on classic accounts, $30 per month on profit-sharing accounts |

| Minimum Copy Trading Investment | Depends on chosen trader |

Pros

- Supports crypto, stocks, indices, forex, and commodities

- Great social feed

- Classic accounts come without fees

Cons

- Not overly transparent on commissions

- A limited number of successful traders on the platform

- Profit-sharing accounts are charged at $30 per month

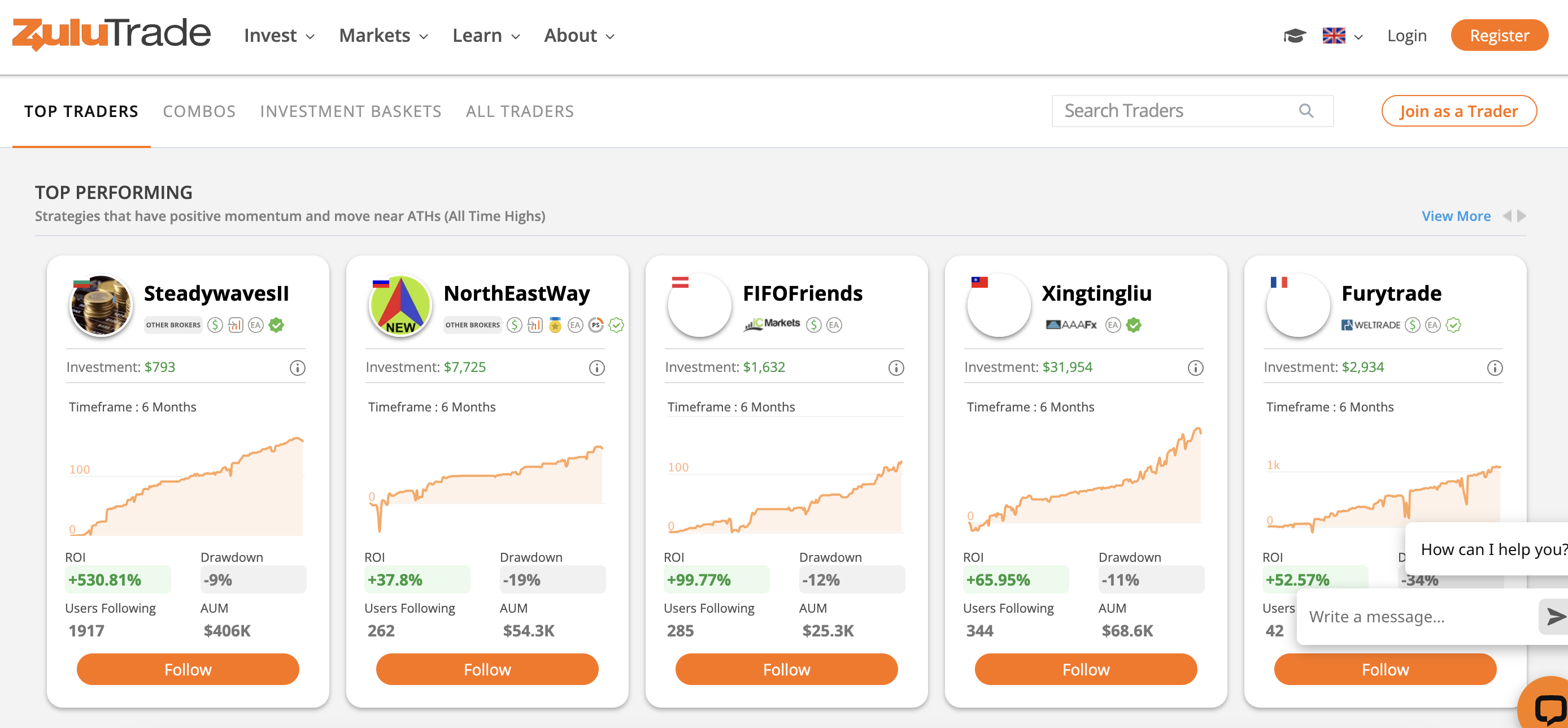

4. DupliTrade – Follow Advanced Copy Trading Strategies

DupliTrade is another copy trading platform that is worth considering. This provider allows users to access and subsequently copy advanced trading strategies. Each copy trading strategy comes with its own risk and upside potential, alongside a target market.

DupliTrade is another copy trading platform that is worth considering. This provider allows users to access and subsequently copy advanced trading strategies. Each copy trading strategy comes with its own risk and upside potential, alongside a target market.

For instance, the wave strategy focuses exclusively on the forex pair EUR/USD. The robust strategy, on the other hand, has a strong focus on indices. Either way, each strategy comes with a clear overview of statistics surrounding historical net profit, trade frequency, suggested leverage, and more.

It is important to note that DupliTrade is not a broker, which means that an account will need to be opened with another provider. For instance, AvaTrade – which offers 0% commission on all supported markets, can connect to a DupliTrade account. This might be a drawback for those that wish to access copy trading services via a single platform.

Another major disadvantage of using DupliTrade is that it requires a minimum deposit of $5,000 to access its trading strategies. This will be the case irrespective of which third-party broker the user decides to go through. Nonetheless, we like that DupliTrade offers a trading simulator. This allows users to backtest a strategy before risking real trading capital.

| Supported Assets for Copy Trading | Mainly forex, but also supports CFDs |

| Social Trading Tools? | No |

| Fees | None (makes money from referring broker) |

| Minimum Copy Trading Investment | $5,000 |

Pros

- Follow advanced copy trading strategies

- Best forex copy trading platform

Cons

- Minimum deposit of $5,000 to access trading strategies

- Does not directly support trading – so need to register with a broker

- Limited number of strategies

5. NAGA – User-Friendly Social Trading Platform With a Great Reputation

The next option to consider from our list of the best social trading platforms is NAGA. This provider is a regulated online broker, which means that there is no requirement to open an account with a third-party platform to access its copy trading tools.

The next option to consider from our list of the best social trading platforms is NAGA. This provider is a regulated online broker, which means that there is no requirement to open an account with a third-party platform to access its copy trading tools.

Therefore, when engaging in copy trading here, users will be mirroring the investments of traders that personally use NAGA. The platform supports a wide range of markets, which is inclusive of real stocks. CFDs are also supported, which covers forex, crypto, indices, commodities, and futures.

This ensures that NAGA users have access to a broad range of traders to copy. When it comes to copy trading fees, this depends on whether or not the position size was worth €10 or more. For instance, positions below this figure will attract a fixed fee of €0.99 without any profit share.

Positions above €10 will also attract a fixed fee of €0.99, in addition to a 5% profit share. Moreover, NAGA users will also need to consider the underlying trading fees. This will depend on the specific asset being traded. For instance, real stocks can be traded at a commission of €0.99 per slide.

When trading CFD markets – such as forex, indices, and commodities, no commissions are charged. Instead, the user will need to cover the spread. In order to get started with a NAGA account, the user will need to deposit at least $250.No deposit fees charged, and supported payment methods include debit/credit cards and local bank transfers.

NAGA is also one of the best social trading platforms to engage with other users. It is possible to see what top-rated traders are doing in real-time, as well as access market insights from hand-picked investors. Moreover, NAGA users can share successful trades to external social media platforms and even like and comment on posts.

| Supported Assets for Copy Trading | Real stocks, CFDs include forex, indices, commodities, ETFs |

| Social Trading Tools? | Yes – extensive social trading feed with lots of features |

| Fees | €0.99 per trade, 5% commission on profitable trades above €10 |

| Minimum Copy Trading Investment | $250 is recommended |

Pros

- Social features support real-time engagement with other users

- When social trading stocks, users own the underlying asset

Cons

- 5% commission taken on all trades that yield a profit of €10 or more

- €0.99 commission every time a position is copied

- Not available in the US or the UK

- A much smaller pool of verified traders when compared to eToro

- Fees are not clearly visible

6. MetaTrader 4 – Advanced Third-Party Copy Trading Software

![]() MetaTrader 4 (MT4) is the most popular third-party trading platform globally – especially for those that wish to speculate on forex in an advanced manner. MT4 can be downloaded as desktop software and it comes jam-packed with charting tools and technical indicators.

MetaTrader 4 (MT4) is the most popular third-party trading platform globally – especially for those that wish to speculate on forex in an advanced manner. MT4 can be downloaded as desktop software and it comes jam-packed with charting tools and technical indicators.

The platform also offers a copy trading service, which allows users to automatically mirror the positions of a selected investor. Each trading signal is provided by a third party and users can access core information surrounding the specific strategy, historical ROI, maximum drawdown, and more.

Fees are set by the respective strategy creator and are typically charged on a monthly basis. Oftentimes, this will average $20-40 per month. Take note, MT4 is not a broker and as such, it is a requirement to open an account with a suitable trading platform to access its features. Once again, Avatrade is a great option here, as the platform offers 0% commission on over 1,250 markets.

| Supported Assets for Copy Trading | Depends on the third-party broker |

| Social Trading Tools? | No |

| Fees | Set by the strategy creator |

| Minimum Copy Trading Investment | Depends on the third-party broker |

Pros

- Highly advanced trading suite

- Offers trading strategies via third parties that can be copied

Cons

- Not a traditional copy trading platform

- No social trading features

- Required to open an account with a broker that supports MT4

7. cTrader – Great Copy Trading Platform for Free Strategies

cTrader is a direct competitor to the previously discussed MT4, insofar as it offers an advanced trading platform for seasoned pros. This covers everything from indicators and custom orders to live pricing charts and the option to copy strategies. The strategies hosted on cTrader are created by third parties.

cTrader is a direct competitor to the previously discussed MT4, insofar as it offers an advanced trading platform for seasoned pros. This covers everything from indicators and custom orders to live pricing charts and the option to copy strategies. The strategies hosted on cTrader are created by third parties.

While many strategies come with a fee, some are completely free of charge. Moreover, cTrader offers a free demo trading facility. This means that users can test free strategies out over a prolonged period of time to assess whether or not they are profitable. Strategies can also be amended to suit the preferences of the user.

Just like MT4, cTrader does not offer direct brokerage services. This means that those using cTrader will need to do so through a regulated platform like AvaTrade. This also means that trading fees and commissions will not be determined by cTrader, but rather by the respective brokerage site.

| Supported Assets for Copy Trading | Depends on the third-party broker |

| Social Trading Tools? | No – but there is a forum for registered users |

| Fees | Both free and paid-for strategies |

| Minimum Copy Trading Investment | Depends on the third-party broker |

Pros

- Third-party trading platform for seasoned investors

- Lots of free strategies that can be copied

- Free demo stock trading facility

Cons

- Does not offer brokerage services

- The best strategies require payment

- No social trading tools other than a forum

What is Copy Trading?

Copy trading is an innovative concept that allows users to ‘copy’ the trades of an experienced investor. This means that the user can actively trade the financial markets without needing to do any research or place any orders. On the contrary, anything that the selected trader invests in will be mirrored in the user’s own portfolio.

The underlying fundamentals of how copy trading works will depend on the respective platform of choice. Nonetheless, here’s a quick example of a successful copy trading transaction to help clear the mist:

- Let’s say that the user signs up at eToro and decides to invest $2,000 into a successful stock trading pro

- The user allocates 25% of their portfolio to buy Amazon stock

- This means that the user will automatically invest in Amazon at a stake of $500 (25% of $2,000 investment)

- A few weeks later, the trader sells their Amazon stock position at gains of 20%

- The eToro user will automatically sell the position, resulting in a profit of $100 (20% of $500 stake)

The above example shows that the user was able to successfully trade Amazon stock without doing any of the work. As such, copy trading is a completely passive investment experience.

Perhaps the most time-consuming part of the process is choosing a suitable trader to copy. This is one of the many reasons why we found eToro to be the best social trading platform in the market, not least because it offers a variety of search filters.

For instance, eToro users can find a suitable trader by checking their historical ROI, assigned risk rating, or preferred asset class. Other useful metrics include the maximum weekly and monthly drawdown, alongside the individual’s average trade duration.

Another thing to note when choosing the best social trading platform is that some sites offer an all-in-one service, while others require third-party integration. Regarding the former, eToro is a regulated broker, which means that its copy trading service can be accessed directly on its platform.

However, the likes of MT4 and cTrader are third-party trading platforms that require the user to open an account with a broker in order to access its copy trading tools.

Choosing the Best Copy Trading Platform

There are many things to consider when choosing the best copy trading platform in the market. This should include the number of traders that the user will have access to, and what fees apply.

For example, NAGA offers a wide pool of investors that can be copied, albeit, any profitable trades of €10 or more will result in a 5% commission share. In contrast, eToro does not charge any additional fees on its copy trading tool.

Instead, the commissions that successful traders accumulate are paid by eToro itself. Another thing to bear in mind when choosing the best social trading platform is the minimum investment requirement.

For instance, at eToro, the minimum requirement stands at just $200 per trader. At the other end of the scale, DupliTrade requires a minimum deposit of $5,000 – which will likely be out of reach for many investors – especially beginners.

Copy Trading Software

Some platforms also offer copy trading software. This can be downloaded to a user’s desktop device and then connected to a third-party trading bot.

MT4 stands out in this respect, as it offers full support for algorithmic bots via its downloadable copy trading software. However, beginners might prefer the likes of eToro, which does not require copy trading software of any sort.

Instead, users can access the eToro copy trading tool via the provider’s website.

What is Social Trading?

Social trading is another innovative feature that is now offered by a number of leading platforms. The main concept here is that users will be able to trade in a social setting that is not too dissimilar to the likes of LinkedIn or Facebook.

For instance, let’s suppose that the user wants to buy Bitcoin and then share their thoughts on why the investment was made. Other users of the platform would be able to see the post and have the option of liking it or perhaps leaving a comment.

eToro – which came out as the overall best social trading cryptocurrency platform, also allows users to follow their preferred traders. This means that any time the trader enters a new position or publishes a new post, the user will be notified.

The overarching objective of social trading is that retail investors can share market insights with the view of building and maintaining a profitable portfolio.

And in most cases, the best social trading platforms in the market also allow users to copy other investors via a single platform.

Is Copy Trading Profitable?

Those wondering if copy trading is profitable will need to understand this is entirely dependent on the person being copied. For instance, if the user invests $1,000 into a trader for 12 months and over this period gains of 70% are made, then this will result in a profit of $700. However, if the same trader makes a loss of 20%, the user would lose $200.

Therefore, choosing a suitable trader to copy is a very important part of the process. With that said, just because a trader has been profitable previously, this does not mean that this will continue to be the case.

After all, the financial markets are volatile and more pertinently – move in cycles. A great way to reduce the risk of losing money from a copy trading venture is to diversify.

For instance, at eToro, a minimum of $200 is required for each trader that is copied. This means that a total capital outlay of $1,000 would allow the user to diversify across five different traders. If one trader has a bad period, there is every chance that this will be countered by the other individuals being copied.

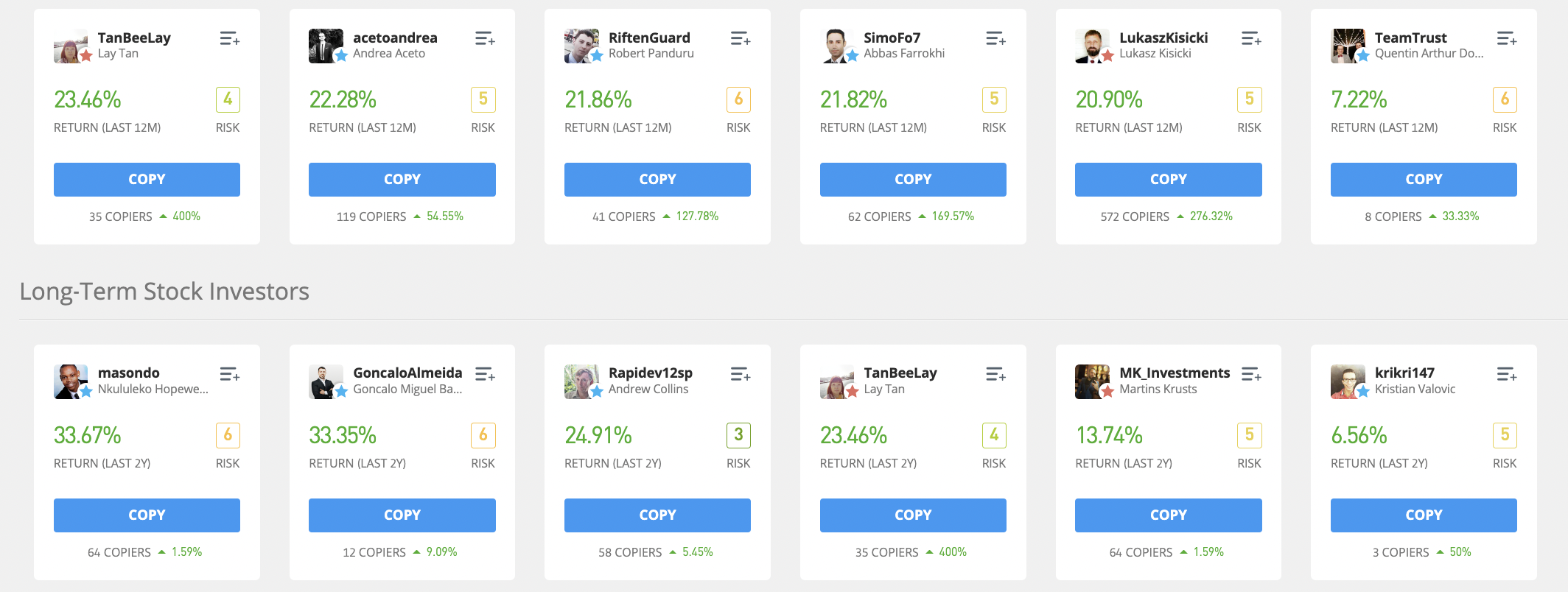

Best Traders to Copy

We compiled some in-depth research on the best traders to copy on eToro, based on a wide range of metrics. This included the specific asset that the trader specializes in, their historical performance since joining eToro, and their assigned risk rating.

Below, we unravel our findings by discussing the five best traders to copy right now:

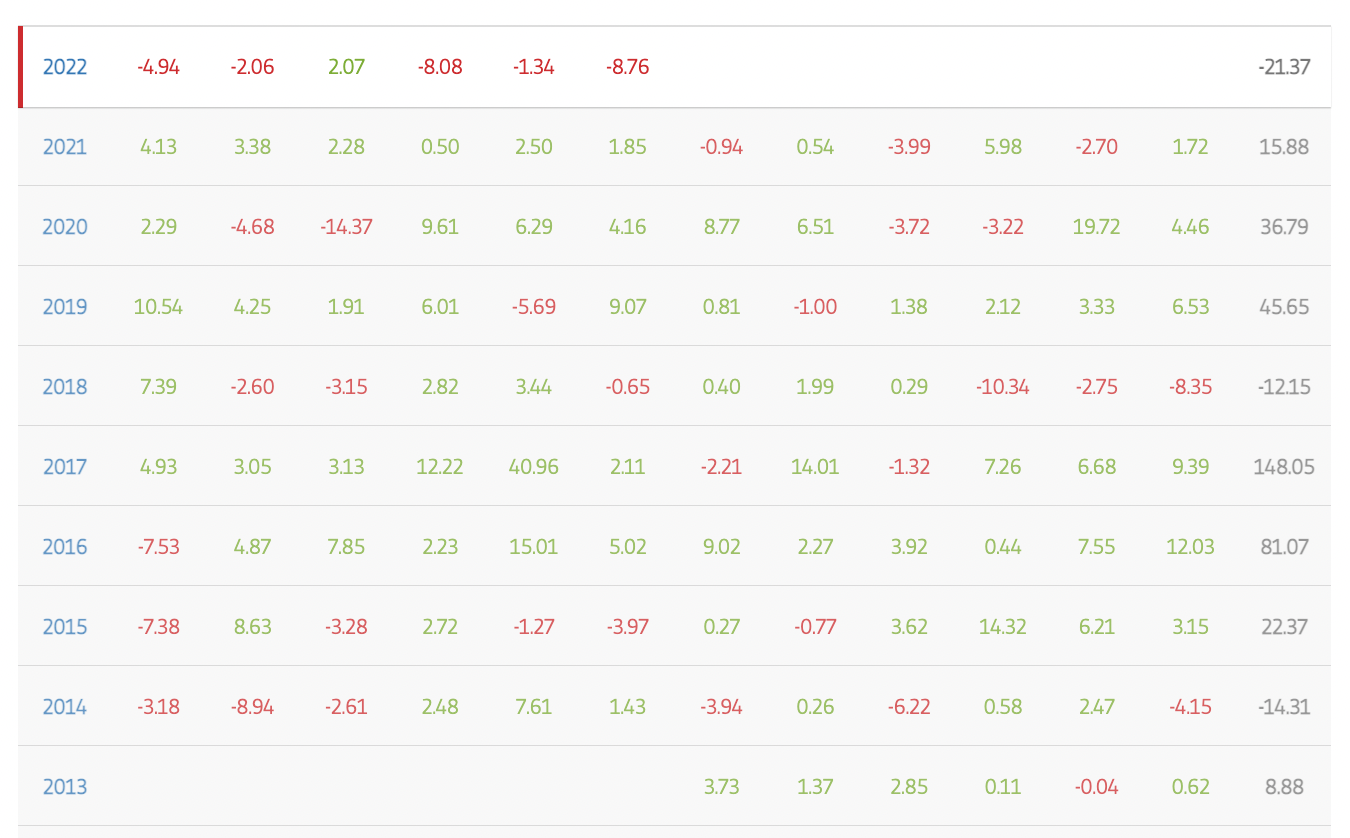

1. Jeppe Kirk Bonde – Overall Best Trader to Copy

Those looking for the most successful traders to copy should look no further than Jeppe Kirk Bonde. In a nutshell, this trader has generated an average annualized return of 28% since joining eToro in 2013. This means that those investing $2,000 into Jeppe Kirk Bonde back in 2013 would now be looking at gains of approximately 800%.

In 2019, for instance, Jeppe Kirk Bonde made gains of 45%, while in 2020, this stood at 36%. The latter is particularly impressive considering that 2020 was a turbulent year for many sectors in the financial markets as per COVID-19. 2021 was also a good year for the trader, with gains of 15% generated.

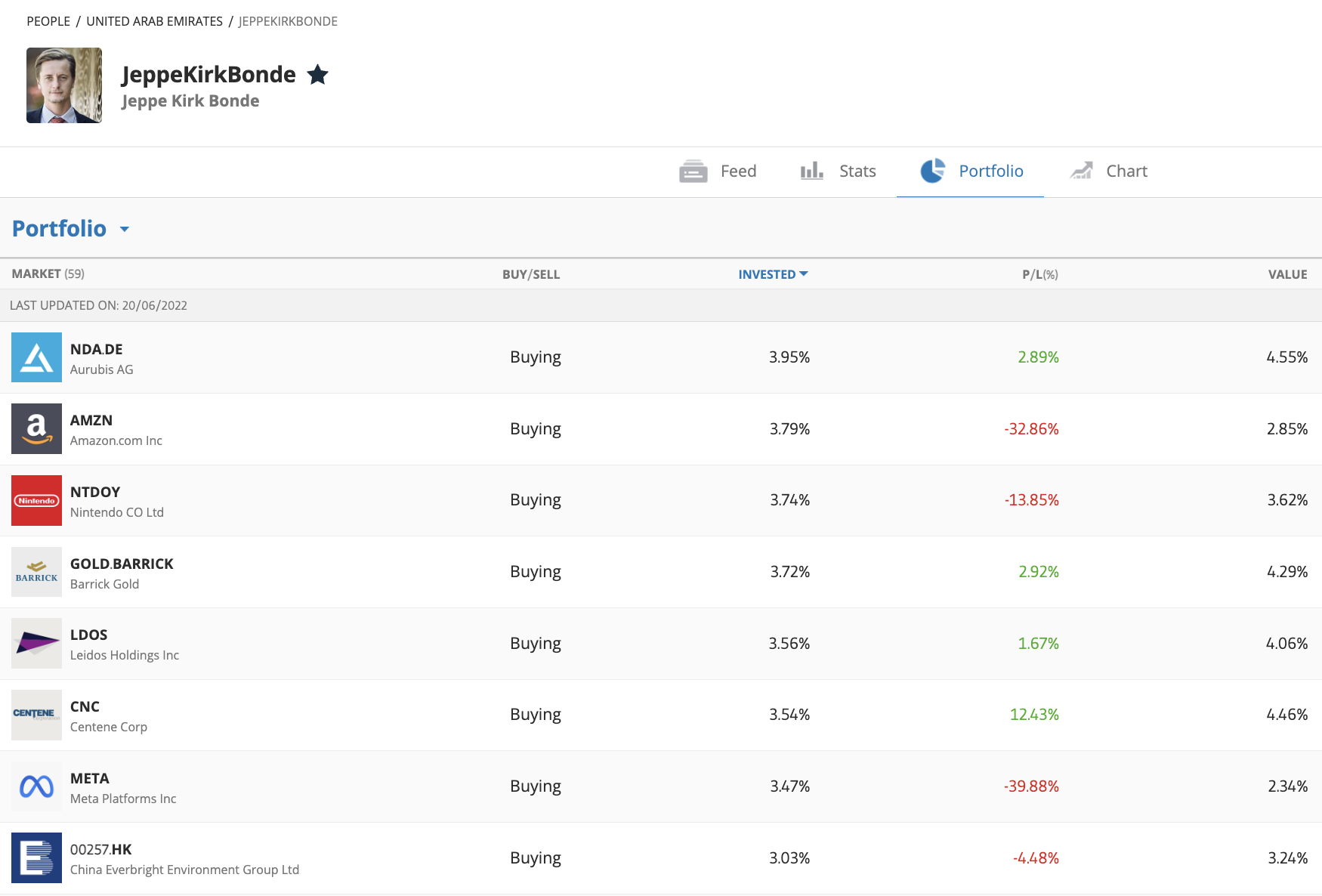

The vast majority of Jeppe Kirk Bonde’s portfolio contains stocks. As of writing, some of the largest weightings in the portfolio include Amazon, Nintendo, Barrick Gold, and Meta Platforms. There is also a very small allocation of Bitcoin, albeit, this stands at just 0.20% of the portfolio size.

2. Terence Loh – Best Crypto Trader to Copy

Terence Loh joined the eToro copy trading program back in 2014. The trader has generated some impressive annual gains during this period, which includes an 85% profit in 2019. 2020 and 2021 saw gains of 99% and 52% respectively.

As of writing, Terence Loh’s portfolio contains just two assets – Bitcoin and Apple shares. Due to the broader performance of the crypto markets in 2022, the portfolio is down 20% as of writing.

While the trader has historically had a strong focus on crypto, eToro has assigned Terence Loh a risk rating of just 4. This highlights that the trader operates in a risk-averse manner. This is further supported by the trader’s maximum weekly drawdown of just 7.7%.

3. Fmorbel – Top-Performing Trader in 2022

While many traders are running at a loss in 2022 due to broader market conditions, Fmorbel is up over 70% at the time of writing. Since joining eToro in 2017, 50% of the positions entered by this trader are crypto-related.

In addition to this, Fmorbel also likes to have around 25% exposure to stocks. Prior to 2022, Fmorbel has returned some solid annual gains. For instance, in 2020 and 2021 respectively, Fmorbel ended the year with gains of 10% and 14% respectively.

In full recognition that the markets are entering bearish territory, Fmorbel has since sold his entire portfolio. The trader will re-enter the market when a suitable opportunity has been identified, so Fmorbel is a great option for those seeking a risk-averse investor to copy.

4. CPHequities – Great Trader to Copy for Diversified Portfolios

CPHequities is a top-performing eToro copy trading veteran that is well diversified across a number of different markets. When it comes to stocks, the trader likes to focus on big tech companies, with some of the largest holdings including Alphabet, Microsoft, Apple, and Amazon.

CPHequities is also a forex trader, with open positions as of writing including EUR/USD, AUD/USD, and EUR/JPY. In addition to this, the trader has also diversified into crypto.

This is inclusive of Bitcoin, Ethereum, Cardano, and BNB. Joining in 2017, CPHequities has closed every year at a profit. This includes gains of 43% and 35% in 2020 and 2021 respectively. Prior to this, the trader made gains of 10%, 26%, and 23% in 2019, 2018, and 2017 respectively.

5. Analisisciclico – Value Investor With a Risk Rating of Just 2

Those looking for a low-risk trader to copy might consider Analisisciclico. As of writing, the trader has been assigned an eToro risk rating of just 2. In 2020 and 2021 respectively, the trader made gains of 7% and 29%.

Historically, the trader has focused heavily on forex, with over 82% of previous positions on major currency pairs. Other markets that the trader likes to gain exposure to include indices and commodities, and a small allocation to crypto and ETFs.

How to Start Copy Trading

This section of our guide will explain how to start copying a top-rated trader on the eToro platform in less than five minutes.

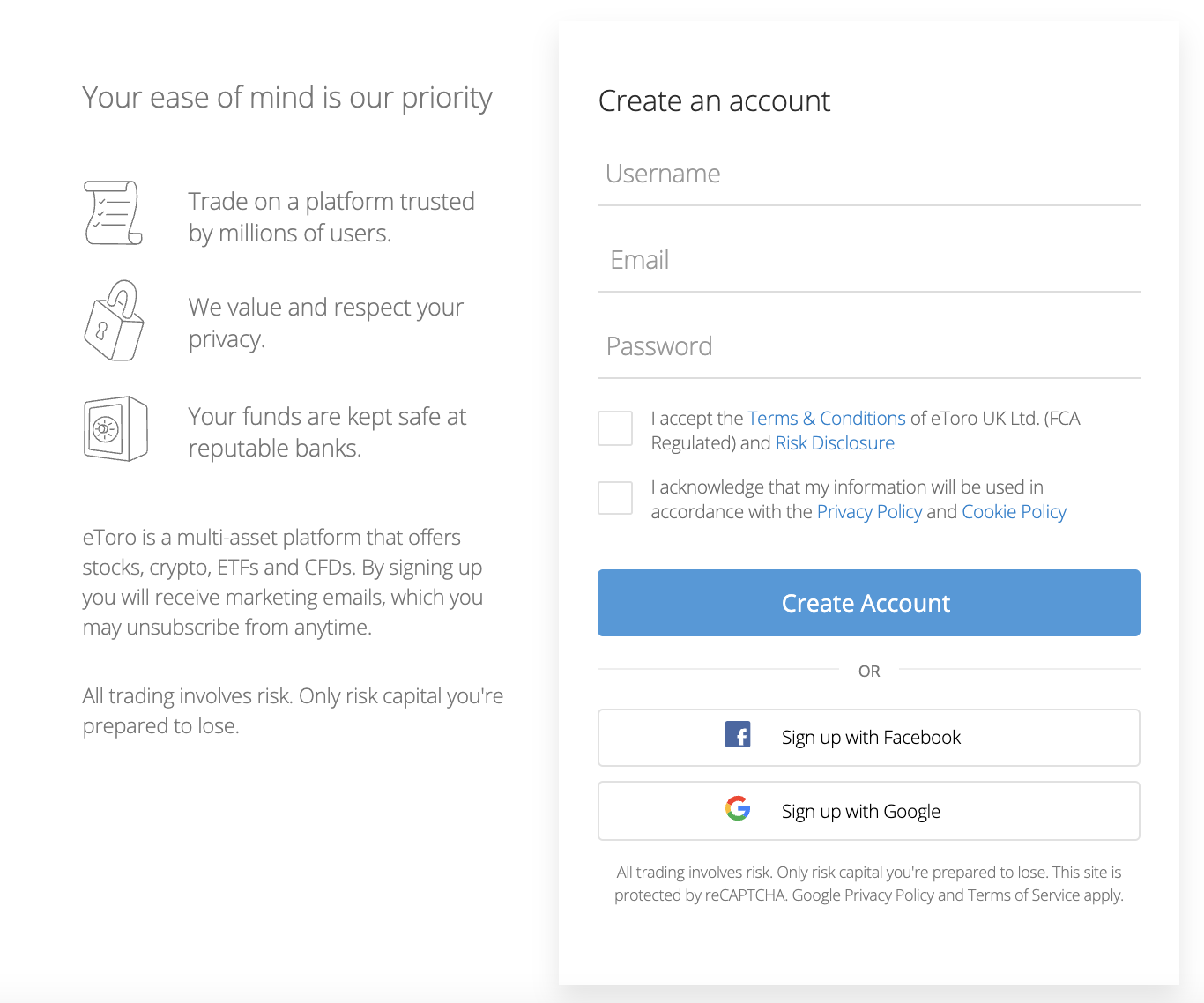

Step 1: Open an eToro Account

The first step is to register an eToro account. As eToro is regulated to offer brokerage services in addition to its copy trading tool, it must collect some personal information.

This will initially include an email address, followed by the user’s first and last name, date of birth, and cell phone number.

Choose a username and password for the account, before answering a few basic questions about any prior trading experience.

Step 2: Upload ID

Another requirement of using a regulated copy trading platform like eToro is that new users will need to upload some ID. This can be a valid passport, driver’s license, or state ID card.

Make sure that the document is uploaded clearly. If it is, eToro should be able to verify the account in a matter of minutes.

Step 3: Deposit Funds

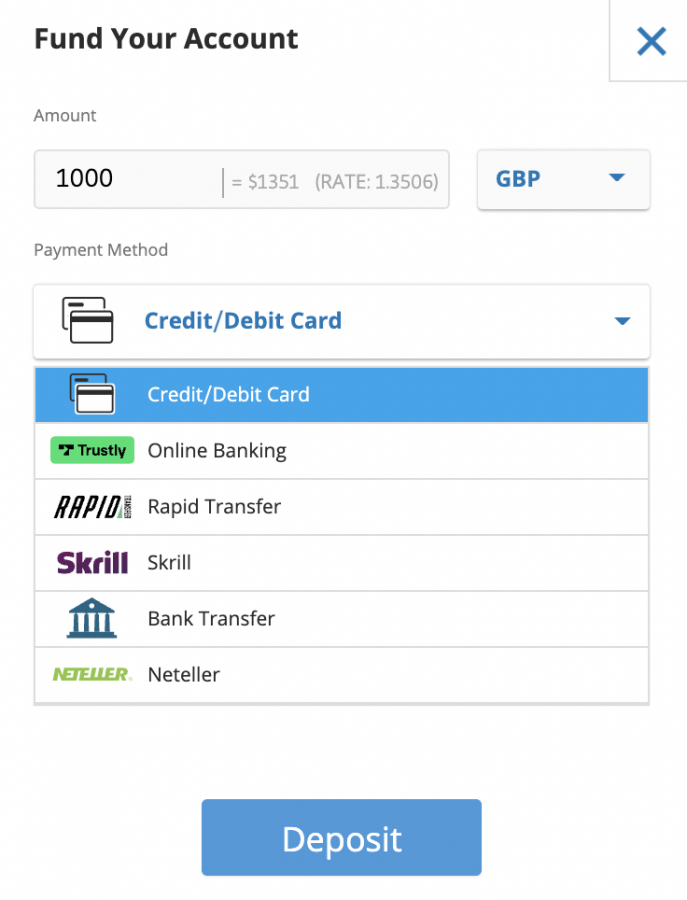

The next step is to make a deposit into the eToro account. The minimum first-time deposit is just $10, but don’t forget that users need to invest at least $200 to use the eToro copy trading tool.

After typing in the required deposit amount, select the preferred payment type from the list of options. eToro accepts Visa, MasterCard, Skrill, PayPal, Neteller, online banking, and more.

Payments made in USD will not attract any deposit fees.

Step 4: Choose Trader to Copy

This step is potentially the most important, as the user will now need to choose a suitable trader to copy. First, click on the ‘Discover’ button on the left-hand side of the dashboard.

Then, click on the button marked ‘View All’ next to CopyTrader.

This will then allow the user to utilize the filters. For instance, users can find a suitable trader to copy based on the preferred asset class, historical ROI, risk rating, and more.

By clicking on a trader, this will then populate their individual profile. This is where the user can research the trader from top to bottom.

Step 5: Confirm Copy Trading Investment

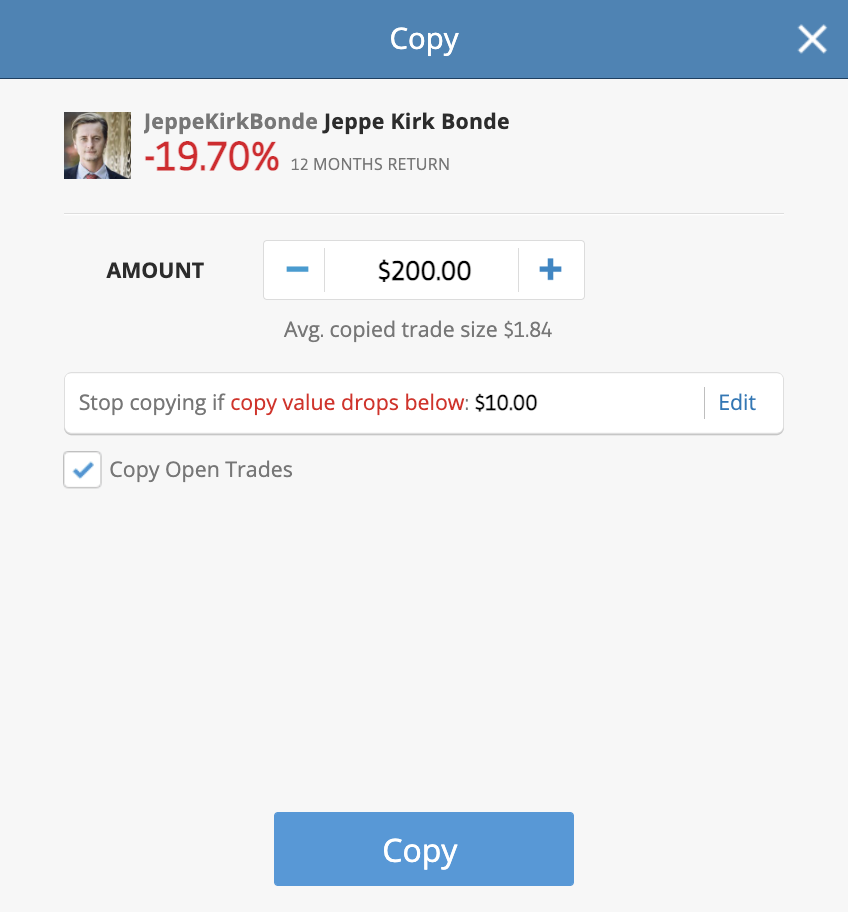

When a suitable trader has been found, click on the ‘Copy’ button. This will then populate an order form, just like in the image below.

First, type in the amount of money to be invested in the respective copy trader.

As noted earlier in our eToro copy trading review, this can be any amount from $200 upwards. Then, make sure that the button marked ‘Copy Open Trades’ is ticked.

In doing so, not only will the user copy future investments, but also the current portfolio. Finally, click on the ‘Copy’ button to confirm the copy trading investment.

Conclusion

The best copy trading platforms allow users to invest in the financial markets passively. All that needs to be done is to choose a suitable trader to copy and decide on an amount to invest.

To get started with the overall best copy trading platform right now – eToro, it takes just minutes to open an account and the minimum investment stands at an affordable $200.

eToro is home to thousands of traders that can be copied and supported markets include forex, stocks, ETFs, indices, crypto, and commodities.

eToro CopyTrader™ Tool

- Buy Crypto & Copy Trade Professionals

- Average 30.4% ROI in 2021

- Average 83.7% ROI in 2020

- Copy a DeFi or Metaverse Portfolio

No comments: