Capital.com Review 2022

Capital.com is a regulated multi-asset broker with offices in the UK, Cyprus, Australia, Seychelles, and Gibraltar. There are already 500,000+ users trading/investing with Capital.com and for good reason. It’s a powerful and well-designed platform but selecting a broker is a very important choice so reading a Capital.com review is a must before committing.

Throughout this article, we’ll be providing in-depth Capital.com reviews, covering the ins and outs of the platform. We’ll be looking at everything from the broker’s fee structure to its customer support, so regardless of an investor’s priorities, every query will be answered.

Capital.com Review: Pros & Cons

Throughout our Capital.com review, we found the following pros and cons the most important to know.

Pros

- Lightning-fast order execution

- Great security

- 24/7 support

- Over 5000 assets

- Range of markets

- MetaTrader integration

- TradingView support

- Demo accounts

- Commission-free

- One of the best scalping brokers for 2022

Cons

- Mostly limited to CFDs

- Not available in the US

78.91% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider.

Tradable Assets

Having a good variety of tradable assets is a key aspect of any broker. More assets mean more trading and diversification opportunities so it can be a big help. The ability to trade a range of different markets on a single platform can also be a massive help as it makes maintaining a balanced portfolio far more simple. In this Capital.com review, we’ve explored each market supported by the broker.

Capital.com Crypto

Cryptocurrency is perhaps the most exciting asset class out there. It provides exposure to digital assets, the most famous of which is Bitcoin. The market is constantly evolving, with the technology improving and new projects being released daily. Furthermore, it’s a favorite among traders as it offers ample volatility, meaning there are more opportunities for lucrative trades without the need for leverage.

It’s possible to CFD buy Bitcoin on Capital.com along with an additional 477 crypto-assets, a roster more impressive than even the likes of Coinbase at just 192. As Capital.com offers crypto as CFDs there’s no need to worry about a Capital.com wallet. Additionally, it should be noted that Capital.com is not licensed to offer cryptocurrency in the UK.

Capital.com supports trading cryptocurrency CFDs but not the purchase of the underlying asset. Despite this, Capital.com crypto trading is versatile and powerful. A CFD is a contract that lets the trader speculate on whether the value of an asset will rise or fall. Using CFDs, it’s possible to take both short and long positions, meaning it’s possible to make money regardless of whether the asset is going to fall or rise in value. However, cryptocurrency CFDs are leveraged, so while profits are magnified, losses will be too.

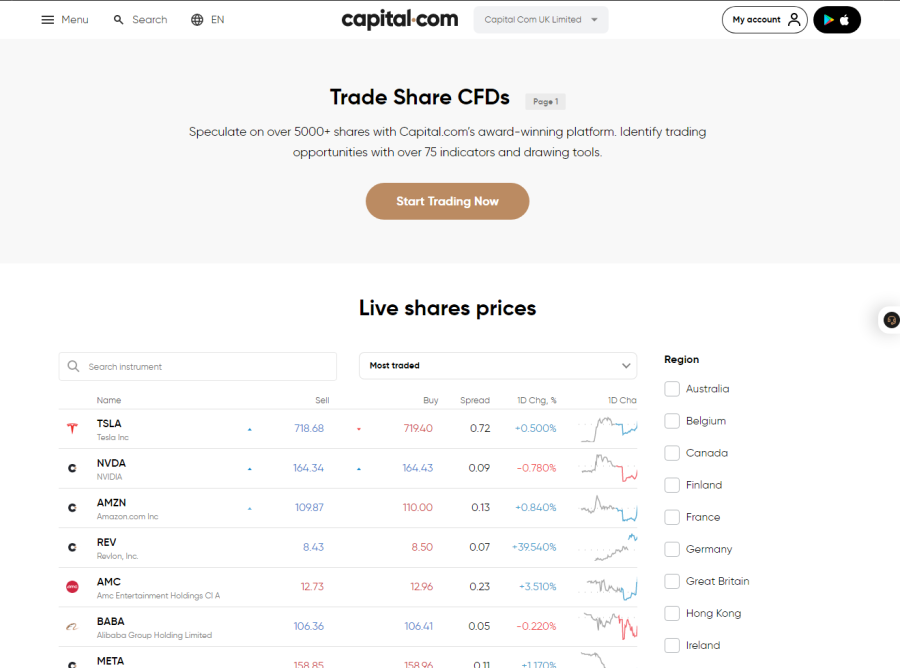

Stocks on Capital.com

Stocks and shares on Capital.com are plentiful, to say the least. The broker supports over 5000 assets and allows users to both trade CFDs and invest in real stocks, making it a great choice for investors and traders alike.

Capital.com users are able to trade stocks in a range of markets including the FTSE 100 and the S&P 500, making it a great platform for international investing. However, despite offering a wide range of CFDs, residents of Australia are not able to trade real stocks. While this can be slightly disheartening the massive variety of CFDs more than makes up for this shortcoming, especially for those looking to take short-term positions.

Despite having only a limited selection of real stocks, Capital.com supports commission-free trading making it a great broker for anyone looking to trade international stocks and shares.

ETFs

Wondering how to trade ETFs? (ETFs) are a type of financial instrument that is typically designed to mirror a specific index or sector. While ETFs can provide exposure to a massive variety of stocks and are therefore excellent for de-risking and diversifying, it’s important to understand that ETFs do not provide ownership of the underlying assets, only a portion of the fund containing them.

Capital.com supports hundreds of ETFs across a range of markets including stocks and commodities. Some of the most popular ETFs are managed by market-leading institutions like Vanguard and iShares. These ETFs are typically seen as lower risk as the funds managing them have great track records.

ETFs are perfect for anyone looking for a passive investment. They are relatively low-risk and are often composed of the largest, most widely traded companies within a sector.

78.91% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider.

Indices

Another instrument users of Capital.com can trade are CFD indices. Indices are built around a range of companies that are traded within a specific index. For example, the UK 100 is a combined measure of the top 100 publicly traded companies. Some of the most popular indices include the NASDAQ 100 and the Dow Jones.

CFD indices can be great for short-term investment as they’re easy to buy/sell, can be leveraged, and typically represent a more complete picture of the market.

At the time of writing our Captial.com review, the broker supported trade in 25 different indices that provide exposure to hundreds of different international companies.

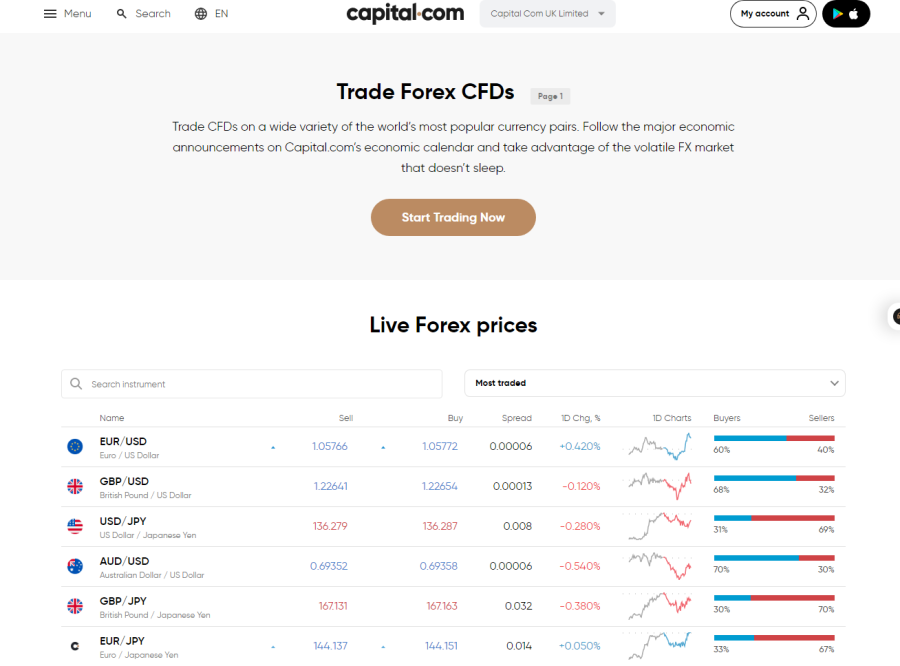

Forex

Forex is the act of trading currency pairs. Typically forex trading involves taking advantage of small price shifts, so having access to ample leverage can make trading forex much more viable. When trading on Capital.com users have access to 30:1 leverage and can start trading from just $100, meaning it’s possible to have a position worth $3000 after depositing just the minimum.

Capital.com covers the vast majority of commonly traded currency pairs; 138 in total. It’s important to be aware, that like most assets on Captial.com, forex pairs are traded as CFDs meaning it’s better suited to short-term trading.

With such a high number of currency pairs and access to an impressive amount of leverage, forex trading on Capital.com is intuitive and powerful. As such, many traders and investors have dubbed Capital.com the best high leverage brokers of 2022.

Commodities

While creating our Capital.com review, the number of commodities and trading tools offered on the platform was wildly impressive.

CFD trading on Capital.com is far from limited. There are over 45 supported CFD-based commodities on Capital.com. You can purchase spot most popular commodities including oil, gold, and copper. However, Capital.com also supports the trade of futures commodities ( a contract to buy/sell a commodity at a specific price). Capital.com clients are able to trade commodity CFDs 24/5 and have access to 10:1 leverage (control a $1000 position with just $100).

Capital.com is a great broker to trade commodity CFDs. It has plenty of educational resources for any traders wanting to learn how to trade commodities and it supports a wide range of assets and provides access to enough leverage to take advantage of any potential dips. Furthermore, Captial.com offers excellent charting capabilities so technical traders will be right at home on the platform.

Capital.com Fees & Commissions

Every broker on the planet charges some sort of fees, after all, they’ve got to make money somehow. However, the type of fees and the rates charged can vary wildly from platform to platform. For example, the Capital.com crypto fees are higher than other asset classes, which can make deciphering fee structures more complex than necessary. To make it easy to understand the Capital.com fees, we’ve broken them down into two easy-to-digest categories; trading fees and non-trading fees.

Capital.com Trading Fees

When it comes to trading on Capital.com, it can be difficult to understand which fees apply as the broker has a different set of fees for each asset class. However, using the below table, any investor can the average fees on each instrument ahead of time.

| Fees | Cryptocurrency | Stocks | ETFs | Indices | Forex | Commodities |

| Fee Type | Spread | Spread | Spread | Spread | Spread | Spread |

| Example | Bitcoin, $90 spread | Tesla, $0.52 spread | iShares U.S. Healthcare ETF, $1.69 spread | US 100, $1 spread | EUR/USD, $0.00006 spread | Crude Oil, $0.02 spread |

Capital.com Non-Trading Fees

In addition to fees linked to trading, there are also Capital.com fees for non-trading activities like position rollovers. Again, it can be difficult to understand the charges as they vary between assets. However, we’ve created this handy table so it’s easy to compare the non-trading Capital.com fees associated with each market.

Deposit / Withdrawal Fees

Before funding a trading account it’s always worth getting familiar with the deposit and withdrawal fees. In contrast to the vast majority of brokers, Capital.com does not charge any fees for withdrawals and deposits. Therefore buying assets using Capital.com is one of the most cost-effective solutions out there, regardless of asset class.

Overnight Fee

The Capital.com fees for taking a position into the next day are based on the amount of leverage used and vary between assets. However, they are some of the lowest on the market, meaning it’s possible to hold positions overnight without incurring steep fees.

| Fees | Cryptocurrency | Stocks | ETFs | Indices | Forex | Commodities |

| Deposit / Withdrawal | $0 | $0 | $0 | $0 | $0 | $0 |

| Overnight Fees | Bitcoin, Short: 0.0140% Long: -0.0500% | Tesla, Short: -0.0219% Long: -0.0225% | iShares U.S. Healthcare ETF, Short: -0.0219% Long: -0.0225% | US 100, Short: -0.0014% Long: -0.0066% | EUR/USD, Short: 0.0035% Long: -0.0092% | Crude Oil, Short: -0.0813% Long: 0.0533% |

78.91% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider.

Capital.com Platforms

Capital.com trading is powered by a number of intuitive platforms designed to help traders to get the get out of the broker. We’ll be taking a look at both the broker’s own propriety trading platforms, as well as, those powered by external companies.

- Capital.com App – The Capital.com app is excellent, we’ll be taking an in-depth look at it a touch later but for a quick overview, it’s well-designed, accessible, and feature-rich making it great for on-the-go trading.

- Capital.com Desktop – The Capital.com desktop app is the broker’s primary trading platform. It won the ‘Best Online Trading Platform’ award in 2020 and features over 75 technical indicators and a wide range of chart types and drawing tools. It’s a great option for anyone looking for a powerful, web-based platform and is perfect for technical traders.

- MetaTrader 4 – Capital.com is compatible with MetaTrader 4, meaning users can link their account and enjoy over 85 indicators as well as benefit from massive customizability and a plethora of professional-grade features.

- TradingView – Capital.com allows its users to integrate with TradingView to experience the best of both platforms. With TradingView being one of the most commonly used tools for charting and plotting technical strategies, this is a big bonus for technical traders.

- Copy Trading – Unfortunately, for those wondering how to copy trade on Capital.com, the broker doesn’t support the feature. However, for those disheartened about the lack of Capital.com copy trading, we’ve got a great article covering the best copy trading platforms on the market.

Is Capital.com User-Friendly?

For a broker to be accessible to the masses, it must be user-friendly. There’s nothing worse than registering with a new broker only to struggle for hours learning where each feature is.

Luckily, Captial.com is incredibly user-friendly and intuitive. It adheres to modern design principles and comes with a sleek, black & white color scheme that’s clear and easy to read. The Capital.com login is easy to see and the onboarding process is pain-free. Although the homepage for signed-in users is a bot busy due to an in-built news feed, every important button is easily visible and not hidden behind any menus. While this might seem basic, it makes getting to grips with the platform far quicker and more streamlined.

It’s easy to find the different markets and platforms, they’re all contained within an easy-to-see hamburger menu and split into relevant sections. Furthermore, each market/product/platform has a beginner-friendly description and clearly signposted fees, ensuring nobody will get confused. Additionally, Capital.com comes with a plethora of educational material that covers everything from basic definitions to more advanced trading techniques. This is perfect for beginners and goes a long way in making the platform user-friendly.

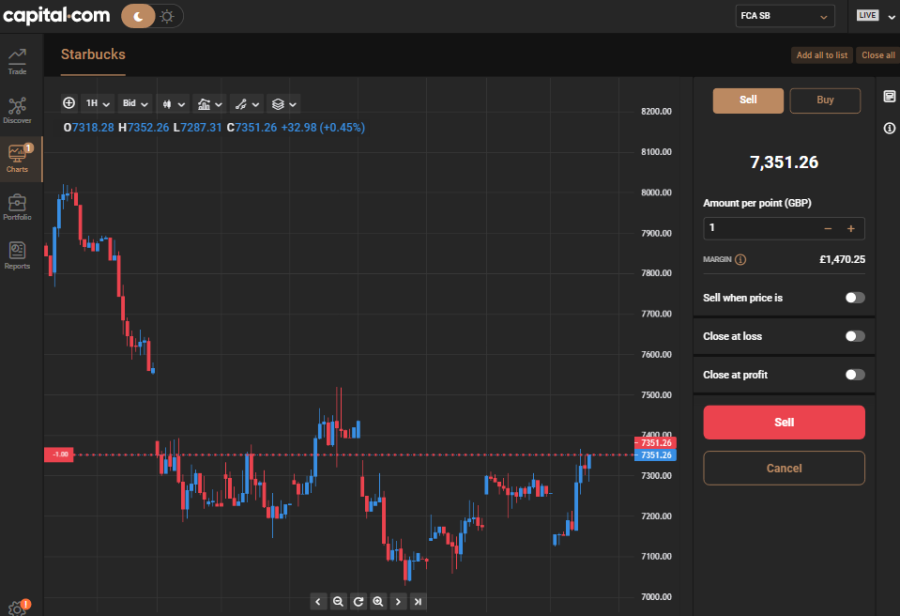

Capital.com Charting and Analysis

As we mentioned earlier, Capital.com is excellent when it comes to charting and analytical tools. It supports both MetaTrader 4 and TradingView meaning users can integrate their accounts with either platform in order to get even more customizability and tools. However, Capital.com’s propriety tools are equally impressive.

With over 75 technical indicators, extensive charting tools, and lightning-fast order execution, Capital.com trades are accurate, fast, and cheap. There are more than enough tools for even the most technical of traders, yet the trading platform remains simple enough for beginners too. On top of its range of tools, Capital.com also provides a section for traders to see which assets have risen/fallen the most, have the most volatility, and view financial news all from a single screen. This is great for finding new assets to trade and makes the research process much more simple.

Capital.com Account Types

Most brokers these days offer a range of account types. This is because not every type can be grouped together, some need specific tools like access to higher leverage or increased deposit limits. There are three different types of Capital.com accounts available to investors, each of which has special requirements.

Demo Account – We’ll be taking an in-depth look at demo accounts further down our Capital.com review but in essence, they’re accounts designed for practicing without using real money and require no prerequisites to use.

Professional Account – Captial.com offers a Pro Trading account for professional traders. These accounts come with access to far higher leverage than a regular account at 20:1 for crypto and stocks and 200:1 for major currencies, indices, and commodities. However, to own a professional account, there are strict requirements. An investor must have a liquid portfolio worth more than 500,000 EUR ($529,571.00), have at least 1 year of experience in leveraged trading for a financial firm, and also have carried out an average of at least 10 significantly sized transactions within the last quarter.

Institutional Account – Institutional investors can create a Capital.com Prime account that provides access to tailor-made trading solutions, a dedicated heading service, and custom analytics. However, Capital.com focuses on building long-term partnerships with its institutional clients meaning only large firms are likely to be accepted.

Capital.com is also considered one of the best Islamic brokers on the market in 2022.

Capital.com App Review

In the modern world, it’s becoming increasingly common for people to trade on the go as we’ve now got access to fast internet from almost anywhere in the world. This allows traders to take advantage of opportunities without being near a computer. Therefore, having a well-designed mobile app is a must.

Thankfully, Capital.com’s mobile app is one of the best. It’s blazing fast thanks to its lightweight and well-optimized nature. When it comes to executing orders, it’s equally as fast as the browser-based Capital.com platform so the only limiter will be having a fast enough internet connection.

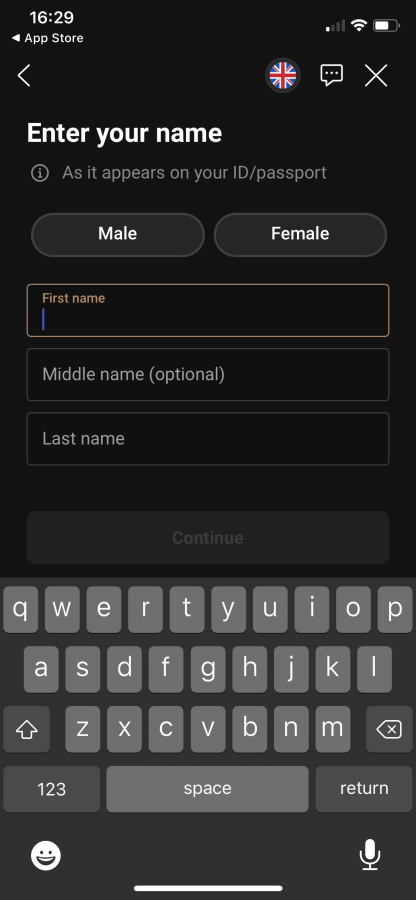

Creating an account is easy, when first opening the app it greets you with a Capital.com UK login (it autodetects country of residence to make opening an account quicker) and guides you through the account opening process. However, while recommended, creating an account isn’t a necessity as investors can still look around and use the demo account features without being logged in and verified.

Trading Capabilities

When it comes to trading, the Capital.com app is surprisingly in-depth. It offers mostly the same charting tools and technical indicators as the desktop platform, making it extremely powerful compared to most other mobile trading apps. Furthermore, the trading section is not overly busy and is intuitive enough even for beginners.

It comes equipped with an extremely well-designed search tool that lets users find stocks based on industry as well as volatility. The news section is also equally as good as it is on desktop, articles are clear, easy to read, and relevant.

Overall, the Capital.com app is very well designed. It features a dark grey and tan color scheme that’s easy on the eyes and sleek. It’s one of the more feature-rich apps we’ve reviewed and yet remains simple enough that even the most novice of investors would have little trouble getting to grips with the platform.

78.91% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider.

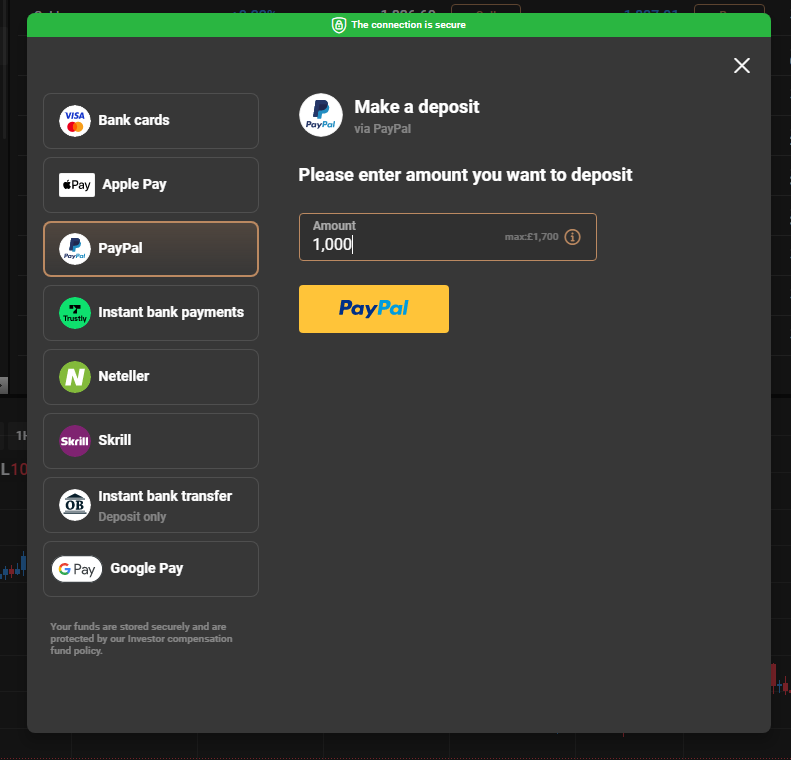

Capital.com Payment Methods

Having a variety of payment methods is crucial for any global broker. Regulations are constantly changing causing some payment methods to become inaccessible in certain regions which could lead to a lot of headache. However, Capital.com supports a wide range of payment methods and covers all the costs associated with depositing, meaning investors not only have plenty of choice but can select the method most convenient for them rather than focusing on fees.

As Capital.com operates globally, it supports quite a few different payment methods:

- Credit/debit card

- Wire transfer

- PayPal

- Sofort

- iDeal

- Giropay

- Multibanko

- Przelewy24

- ApplePay

- Trustly

- 2c2p

Capital.com Minimum Deposit

Throughout our Capital.com review, we found the broker is quite generous when it comes to minimum deposits. The broker does not charge any fees for deposits and has a tiny minimum deposit of just $20 making it an extremely accessible platform, regardless of financial backing.

Capital.com Withdrawal Times

The Capital.com withdrawal fee is non-existent and withdrawal times are processed within 24 hours. However, Capital.com does state that the time between the funds getting transferred and landing in a bank account can vary based on the banks operating procedures.

Capital.com Bonuses & Promos

It’s fairly common for brokers to offer various sign-up bonuses or run attractive promotions. It’s a way of drawing users into the platform and usually rewards the budding trader with cash or stock, meaning both parties come out on top.

While Capital.com does lack any sign-up bonuses, it has a rather lucrative referral system. It’s possible to invite friends to the platform using a unique link and when they register they’ll be given a personal account manager as well as a walkthrough of the platform. Then, after they deposit at least $200 and make three trades, the referrer will be rewarded with cash.

The rewards system is tier-based as follows:

The FCA referrer can receive up to 250 USD (EUR, GBP) per quarter:

– 1st friend – 25 USD / 25 EUR / 25 GBP

– 2nd friend – 25 USD / 25 EUR / 25 GBP

– 3rd friend – 50 USD / 50 EUR / 50 GBP

– 4th friend – 50 USD / 50 EUR / 50 GBP

– 5th friend – 100 USD/ 100 EUR/ 100 GBP

Capital.com Demo Account

Most brokers will offer users a demo stock account to get to grips with the platform and practice strategy without the worry of wasting real money. Capital.com provides all users with access to a demo account that is essentially exactly the same as a real account, just without real funds. A lot of brokers will offer a demo account with restricted features so this is great to see.

Each demo account comes with $1,000 in funds for traders to practice with which is more than enough for most beginners. However, users are able to open more than one demo account and can split them easily, making Capital.com a great platform to practice trading within a range of markets at once.

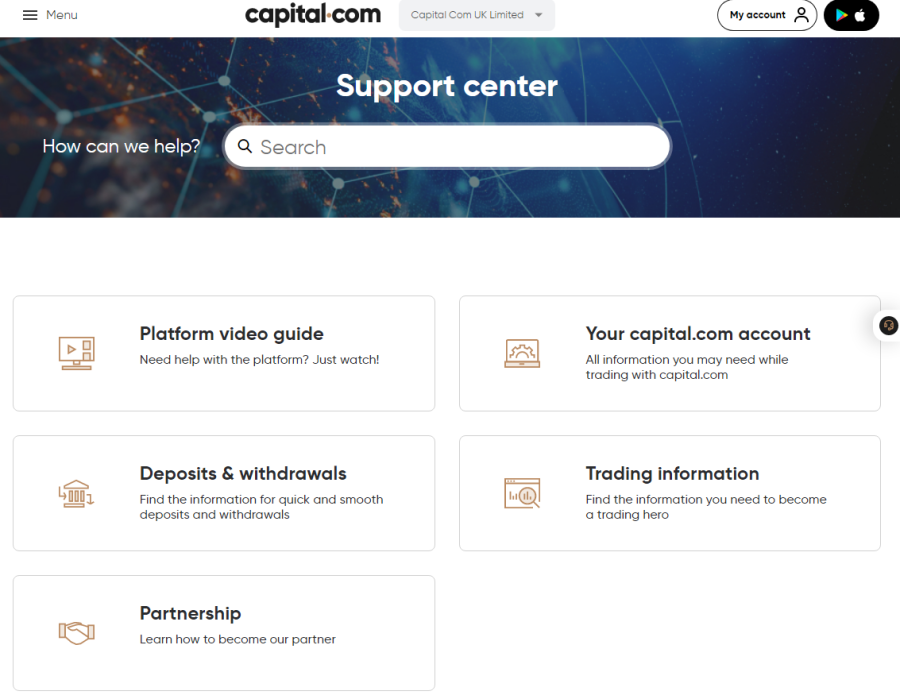

Capital.com Customer Support

Customer support is at the core of every trading platform, at some point, everyone has a question they don’t know the answer to which is when having access to prompt, competent support pays for itself.

Capital.com provides its users with three different ways to contact support; email, phone, and live chat. Live chat is available 24/7 and the support agents give detailed answers and clearly know their stuff. Email support is equally as good in terms of answers but admittedly not quite as fast. Lastly, it can be difficult to reach an agent via phone, likely as they simply lack the staff to deal with everyone’s queries. So while it’s easy and fast to get a coherent answer, phone support can be a bit hit or miss.

Capital.com Licensing & Security

Capital.com is a regulated broker with offices in several countries around the world. As such, Capital.com is regulated by multiple leading bodies including the FCA, CySEC, ASIC, and the FSA. This means that crypto.com clients are well protected and should always have recourse if something goes awry in the background.

During our Capital.com review, it became clear the platform cares about its users. The broker adheres to guidelines laid out by regulatory bodies including the segregation of client and corporate funds, ensuring that clients should never have an issue when it comes to withdrawing their funds. Another way Capital.com protects its users is its PCI Data Security Standards compliance. This means Capital.com follows strict rules to ensure customer information remains safe and obscured. Overall, Capital.com is a secure, regulated platform that does well to protect its users.

Capital.com Accepted Countries

Although Capital.com operates in the majority of the world, there are few countries where the platform is unavailable or restricted. Residents of the UK don’t have access to cryptocurrency, Australian citizens cannot trade real stocks, and US residents are prohibited from using the platform entirely. However, outside of these regions, Capital.com is available in another 178 countries and is mostly unrestricted.

How to Start Trading with Capital.com

Our Capital.com review wouldn’t be complete unless we explained how to trade with Capital.com. Learning can be a daunting task, but by following the below steps, anyone can buy and sell with Capital.com.

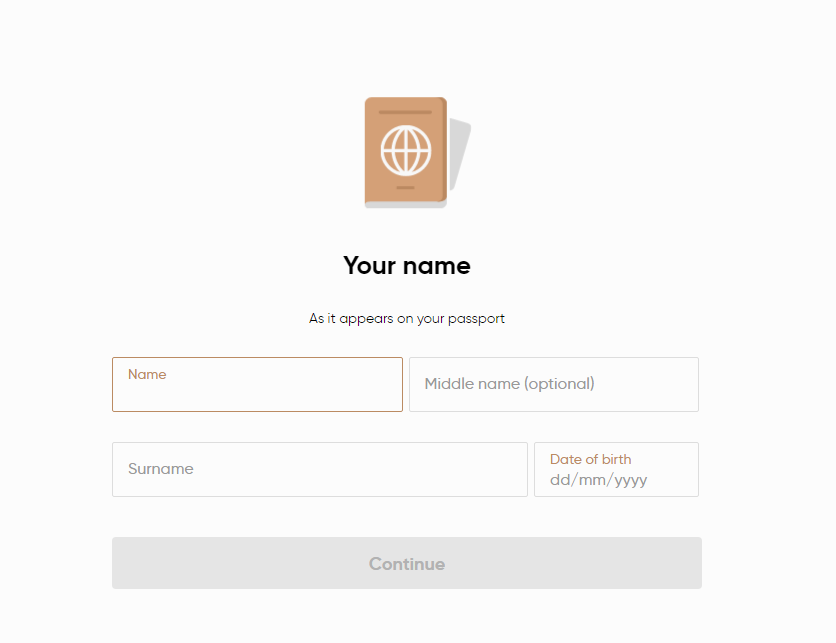

Step 1: Register with Capital.com

The first thing any investor needs to do is register for an account with Capital.com. This can be done by heading to the Capital.com website and providing some basic details like name and email address.

78.91% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider.

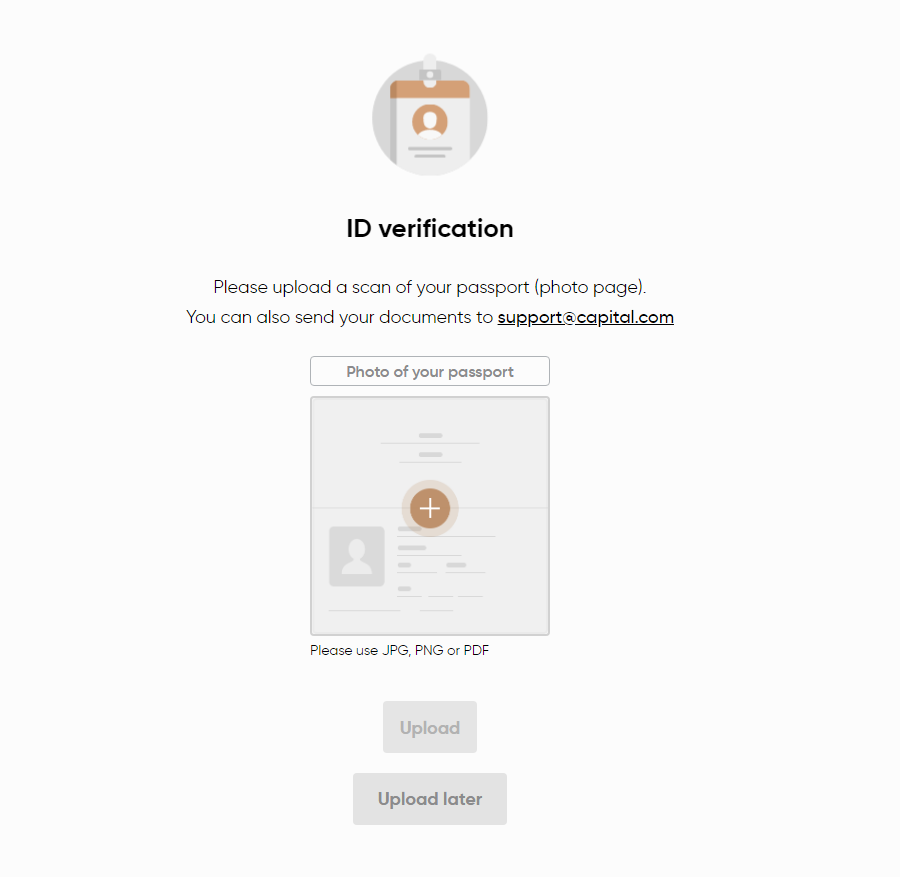

Step 2: Verify Account

After the account has been created, it needs to be verified. This is because Capital.com is a regulated broker and therefore has to comply with know-your-customer regulations. Luckily, the verification process only takes a couple of minutes with the only information required being a photo ID (passport, driving license) and proof of address (bank statement, utility bill)

Step 3: Deposit Funds

Once the account has been verified, it’s time to deposit funds. This can be achieved by heading to the ‘My Accounts’ section, then pressing deposit, selecting a payment method, deciding how much to invest, and finally pushing ‘Deposit’ once again. The funds will arrive promptly, however, first-time deposits are known to take a while longer.

Step 4: Buying Assets

After the funds have been credited, it’s time to trade. This can be done by clicking on the Capital.com search bar, typing in the name of an asset, choosing how much to invest, and lastly pressing ‘Buy’. Positions can be monitored from the portfolio section Capital.com.

Step 5: Selling Assets

Figuring out how to sell on Capital.com is simple. First, select an asset, switch to the ‘Sell’ tab, choose how much to sell, and then press ‘Sell’. Once the order executes, the funds will arrive in the account.

Conclusion

Throughout this Capital.com review, we’ve analyzed the ins and outs of the broker, explored its features, and discussed how it performs as a trading platform.

Overall, after completing our Captial.com review, we found that it’s one of the best brokers on the market for investors of all goals and skill levels. It has something for everyone and is incredibly powerful, making it the clear choice.

78.91% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider.

No comments: